Following the example of one of the largest LVMH luxury groups, the Artemis Group of F. Pinault, in February of this year, also acquired a minority stake in Champagne, investing in Jacquesson. This interest on the part of multinationals translates into a clear sign of the good health and potential of this fascinating region. Obviously the surge that Champagne prices has now taken, recording the highest price increase in 2019 compared to all the other regions, is not destined to decrease indeed, the investment of Artemis will only be able to reposition the product acquired in a higher price range. Currently a champagne belonging to the few prominent maison, costs on average, almost the same as a Bordeaux wine.

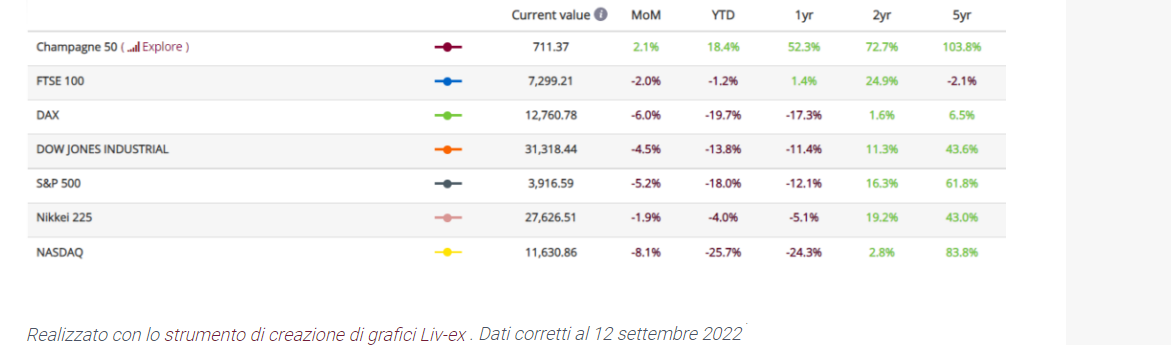

If ten years ago Champagne represented 2% on the secondary market, today it represents 12.4% (in Italy 11.9%, therefore not very far behind) and has become the third region in terms of number of trades; in the last four years it has grown by 52.3% and in the last two, by 72.7%. A decidedly exciting price increase when you consider that the stock market has suffered a weakening in the value of financial stocks while the luxury market with constant growth, has benefited, providing the investor with a stable secret weapon for portfolio diversification of investment: the Louis Vuitton Moet Hennessy Group with Moet & Chandon, Dom Pèrignon, Veuve Clicquot, Krug, Ruinart and Mercier, declared a growth of 28% in revenues in the first six months of this year.

As we have repeatedly pointed out, the Champagne 50 index outperformed other assets such as the FTSE 100 (24.9%) and the S&P500 (16.3%). Luxury goods in general and fine wines in particular performed brilliantly because they were able to maintain constant price growth without reducing demand. In fact, in July of this year, each sale proposal was matched by more than one and a half purchase requests: a symptom of strong demand on the market.

In short, the investors have placed their trust in the Champagne market and the most determined ones have been, since the beginning of the year, the British ones who hold 40.3% of the total trades. Even the American market, after the exemption of duties (2021) on the importation of European wine, by the Biden administration, returns to be an important engine of trade for wine and in particular for Champagne which earns its market share of 39.1%. The Asian market, on the other hand, continues not to give satisfaction to Champagne (7.4% of total wine exchanges) and confirms its historical preference for reds (81.1% of exchanges), in particular on Bordeaux and over the most recent years also on Burgundy.

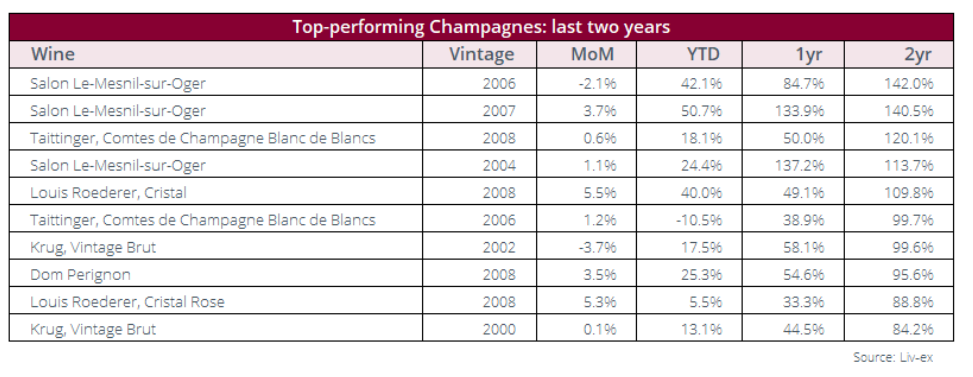

Looking again at the last two years, we follow the price increase that Champagnes have had, to understand what the records they have achieved on the market are.

The average price per bottle increased by 76.7%. It is currently 636 euros (in 2019 it was 360 euros), but the price of some Champagnes in particular has increased by over 140%.

Salon Le Mesnil which is part of the Laurent Perrier group, had a price increase of 142% for vintage 2006, 140% for vintage 2007 and 113.7% for 2004) and is the third most traded Champagne by value over the last year. In Vintage 2002 it is the one that has had the greatest increase, in the last 7 years, compared to the release price, 392.9%. Produced in 60,000 bottles, the Salon 2002 earned J.Robinson a score of 19.5/20.

Tattinger Comtes De Champagne had an average increase of 94.3% and 120.1% for vintage 2008

Louis Roederer Cristal has performed on average by 84.6% with the remarkable percentage of growth (109.8%) of Cristal 2008 and with 88.8% of Cristal Rose 2008.

Krug has increased its average value by 84.1%, its 2002 brut vintage by 99.6% and its 2000 brut by 84.2%.

The average price of Dom Pérignon instead increased by 67.7% with 95.6% for the 2008 vintage.

Perrier Jouet’s Belle Epoque also increased its value by 50.6%.

Philipponnat Clos De Goisses, the first Champagne to be offered in 2021 at the Place de Bordeaux in Vintage 2012, increased by 36.7%, but the 1990 Dom Perignon P3 holds the record in exchange value, which reached the top of €4,657.00 per bottle, while the one for the quantity of exchanges is of Cristal 2008 which this year was the most purchased among the Champagnes, the most sold in all fine wines and the most traded in large formats: an absolute record ! It also received a score of 100/100 from James Suckling and 99/100 from Galloni which confirm, if it were still needed, the extraordinary nature of this wine.

The focus on Champagne has therefore intensified and as the market matures, it expands outwards to incorporate less high-sounding names and other styles; buyers need to find satisfaction in a wider offer. 579 different Champagnes have been traded since the beginning of the year, but the number is still set to rise. Already grown 7 times over the last decade, this expansion is proof that investors have become more adventurous by contributing to the inclusion of small Maison that focus their identity on the vigneron such as Selosse, Egly-Ouriet, U.Collin.

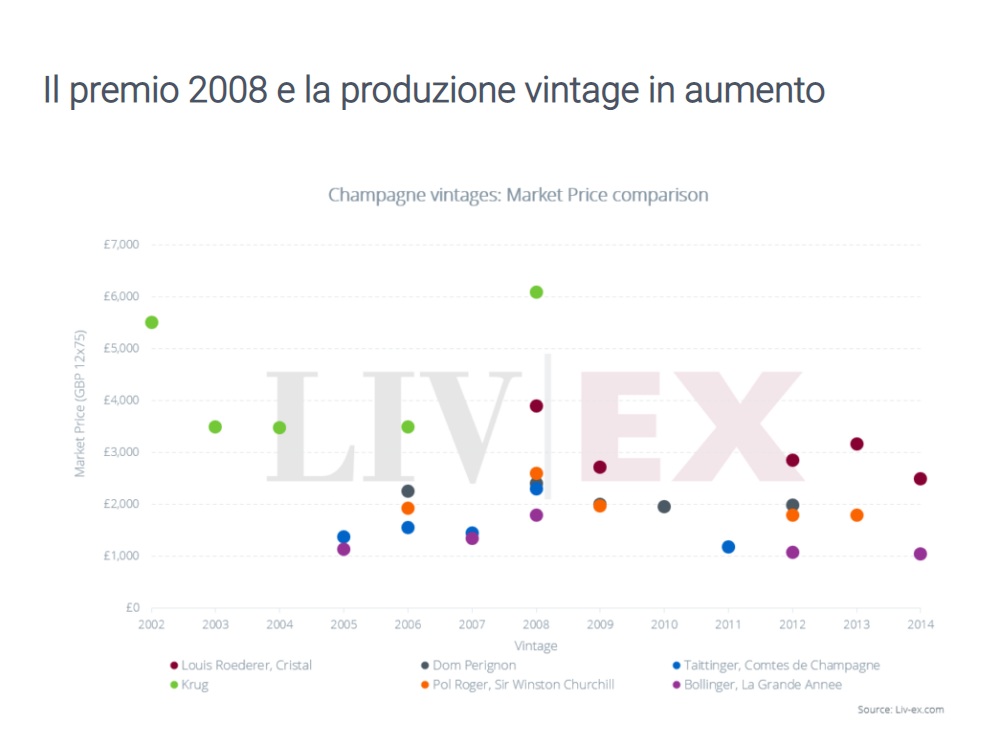

Of course, focusing on a year judged by all experts as “spectacular” does not make even the less experienced trader run too many risks, but often the speculative margin of intervention expands in those years judged to be “medium” precisely because of the lower price upon release.

But let’s clarify … The vintages are classified according to the climatic trend in that particular terroir and the experts make a forecast on the trend of the harvest. This creates an expectation that influences the market in advance and the demand for widely acclaimed vintages increases, as happened for 1996, 2002, 2008. The next release in line with the singularity of these vintages seems to be the vintage 2012 from which great results are expected.

The scores of the critics are added to these dynamics capable of generally conditioning the wine market. The vertical rise of Champagne did not follow the established market rules and it should not be forgotten that the region is still in a relatively early stage of its development. Therefore, high critics’ scores do not always correspond to great vintages and vice versa, while great vintages always correspond to higher release prices. Vintage 2008, for example, is a distinctive sign compared to the other noble vintages because, in addition to having the highest exit prices, it is the only vintage produced and released by all six of the most successful Maisons globally.

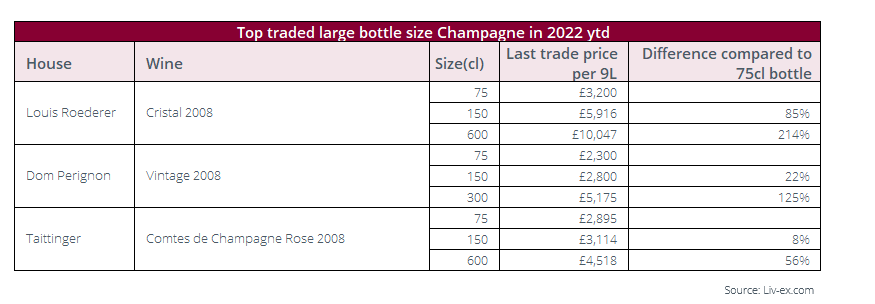

Large Champagne formats have also increased their average price by 63.6% since the beginning of the year. The most traded are the Magnums. Of course the production is lower, but their growth is not directly proportional to the capacity of the bottles. The rating is much higher for the same units of measurement.

Let’s take for example the Cristal 2008, always this one! The Matusalem format (6 litres) currently has a market value of around €11,457.00 while a case with 12 75cl bottles (equal to 9 litres total) is traded at €3,429.3. Despite this economic evaluation, no one could ever trivially comment on this data by saying “you pay more to drink less” because the immense charm of large formats is like a unique magic and anyone who loves Champagne deserves to be overwhelmed at least once in their life.