When Princeton economist Professor Orley Ashenfelter published what is now known as the Bordeaux Equation in 1990, the outrage was immediate and fierce.

Robert Parker dismissed it as ridiculous.

William Sokolin (of Sokolin LLC) openly mocked it.

The New York Times went so far as to publish an editorial with the provocative title: ‘Let’s keep economists away from the vineyards’.

Why so much indignation?

The equation promises to distinguish a great vintage from a mediocre one with only three parameters: winter rainfall (200-300 mm to prepare the soil), temperature during the vegetative cycle (19-20°C for ideal ripening), rainfall during harvest (less than 30 mm to avoid dilution and grey mould).

A ‘great vintage’ occurs when nature aligns itself perfectly with these parameters, producing wines not only of exceptional quality but with immense potential for price appreciation.

Needless to say, those who profit from the ignorance of end consumers are outraged. In the words of Sophocles: ‘Sweet is the profit, though it springs from deceit.’

Why vintage is crucial

I began writing about investments in fine wine with this very question in mind:

Can wines from bad vintages be good investments? (It was about Bordeaux En Primeur 2021…)

The question of vintage is central to understanding wine price trends over time. In other words, the quality of the vintage is a key element in investing in fine wine.

Yet, in trying to understand which vintages are of quality and which are not, one finds a sea of politically correct language-reviews in rosy tones that guarantee the favour of producers and consortia to critics.

For this reason, I report below, without frills, four important facts about the quality of vintages and the impact it has for investors and collectors.

1. Vintage matters more in Europe than in the New World

Climate variability is the factor that most influences vintage quality.

– In Europe-mostly Bordeaux and Burgundy, but also Champagne, Tuscany and Piedmont-the climate varies greatly from year to year. A dry harvest after a hot summer can create exceptional wines, while a rainy year can ruin them.

– In the New World-regions such as Napa Valley, Australia, South Africa-the climate is more stable, and the annual variation is minimal.

For investors, this means that European wines show great variability. Good vintages emerge as extraordinary, with significant value appreciation. In the New World, as the variation between vintages is minimal, prices are also more stable and show less volatility.

2. Bordeaux market structure rewards ageing

Bordeaux wines (but also wines from Tuscany and Piedmont, …) improve with time, creating two distinct markets:

– Primary market: wines still in barrel, sold en primeur, or in any case before optimal drinkability, similar to new issues in the financial markets.

– Secondary market: mature wines reaching higher prices, securities on the secondary market.

The opportunity for investors lies in buying the right vintages during release-those with excellent weather conditions-and waiting for them to mature. For this reason, Wine Wins almost exclusively buys En Primeur wines, although this practice is less convenient than in the past, for several strategic reasons:

– Guaranteed allocations: Ensure the most popular wines.

– Choice of format: Preference for formats such as magnums, which are particularly popular in the market.

– Packaging options: Preference for 3x75cl, more easily resold.

– Savings on storage: Reduction of costs up to commercial release.

– Customer loyalty: Creating a relationship of trust and continuity.

As far as Bordeaux is concerned, critical scores are essential. Tools such as Liv-ex Fair Value are used and the ratings of influential critics such as William Kelley (Robert Parker), Neal Martin (Vinous) and, to a lesser extent, Jane Anson are monitored. The most significant differences can be seen in wines achieving scores above 98/100, with a crucial impact on those achieving 100/100.

The focus of Wine Wins is on:

– Ultra-rare wines: such as Haut-Brion Blanc, which attract collectors and investors.

– Competitively priced labels: e.g. Carmes Haut-Brion, La Gaffelière, Montrose, Canon, and Léoville Las Cases.

This strategy combines commercial value, critical relevance and market preferences to maximise investment and resale opportunities.

3. Climate predicts quality, not release prices

Although climate is a reliable indicator of a wine’s quality, it has little influence on release prices.

Why?

– Production costs: In difficult years, production costs are paradoxically more expensive (e.g. manual selection of grapes, specific interventions in the vineyards, etc.).

– Brand Reputation: Producers set prices based on their image, avoiding large discounts so as not to damage the brand.

– Short-term focus: châteaus often ignore the long-term potential of vintages, which only becomes apparent on the secondary market, and focus on the costs, reputation and market dynamics of other neighbouring and competing châteaus.

4. Vintage quality drives long-term appreciation

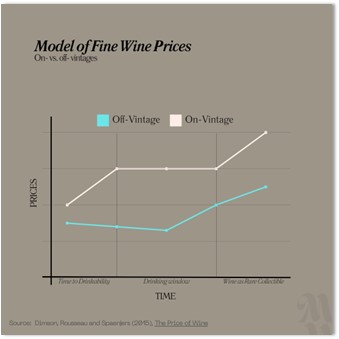

An article entitled ‘The Price of Wine’, conducted by Dimson (Cambridge Judge Business School and London Business School), Rousseau (Vanderbilt University) and Spaenjers (HEC Paris), is one of the most authoritative studies on investment wine returns and shows the following:

– Great vintages appreciate faster: Wines produced under ideal climatic conditions show a steady growth in value on the secondary market as they mature and develop complexity.

– Difficult vintages have limited growth margins: They mature faster, offering fewer opportunities for long-term appreciation.

In summary, vintage is the compass that guides the long-term value of wines, as exemplified in the chart below.

So, can wines from difficult vintages be good investments?

Yes, but with certain reservations.

– Great producers: The best manage to mitigate adverse weather conditions with exceptional vineyard management techniques.

– Discounted prices: Less favourable vintages often enter the market at lower prices, creating opportunities for growth if these wines then exceed expectations in bottle tastings.

– Revaluation: Sometimes, wines from difficult vintages surprise the market as they age and gain complexity.

However, it is in great vintages that the real opportunities lie.

These combine superior quality and strong demand over time, offering the kind of appreciation every investor dreams of.

Article written by Sara Danese, CFA, combines her financial expertise with her passion for wine in her Substack In the Mood for Wine (https://www.inthemoodforwine.com/).

Don’t miss the rest of the article on Substack: https://www.inthemoodforwine.com