Why diversify, you may ask?

The saying goes: don’t put all your eggs in one basket which, in financial parlance, means: diversify.

And again in asset manager jargon: investors who wish to reduce volatility and improve their portfolio diversification are increasingly including alternative assets.

But why reduce volatility? And how?

In theory, reducing volatility also means reducing returns. The goal of a careful investor, therefore, is to mitigate volatility just enough to make the portfolio more stable, without sacrificing too much in terms of future returns. A balancing exercise: sleeping soundly without falling behind the market.

To achieve this, it is crucial to combine assets that do not all move in the same way. In other words: correlation is the key.

If I own an ETF that replicates the S&P 500, I would ideally want to combine it with an asset that goes up when the US stock market goes down. An asset that systematically moves in the opposite direction has a perfect negative correlation of -1.

Correlation is measured on a scale of +1 to -1:

– +1 indicates a perfectly synchronised movement

– 0 indicates no correlation

-1 indicates perfectly opposite movement

Now, some inconvenient realities:

- Assets with perfect negative correlation do not exist.

- If they did exist, the gains of one would wipe out the losses of the other, making the expected return zero.

- In times of crisis, when fear is collective, correlation tends to increase: even normally decorrelated assets start moving in the same direction.

Returning to portfolio construction: the objective is to combine assets that are weakly correlated but with positive expected returns, while managing other risks such as liquidity or valuation uncertainty.

The percentage to be allocated to each asset depends on the investor’s wealth, time horizon and objectives. The traditional portfolio includes a higher proportion of equities in the early years (more time to recover any losses) and an increase in the bond component as you approach retirement. In recent years, however, more and more investors are turning to alternative investments.

And this is where investment wine comes in.

Like any good thing, it should be consumed in moderation. In financial terms, this means devoting a share of generally no more than 5% of the portfolio to this asset except in the case of large assets (there are rigorous methods for estimating this threshold, as mentioned in this article).

Why this caution? Because although investment wine offers real advantages, it also has some structural disadvantages: low liquidity, high bid-ask spreads, a certain opacity in valuations, if not supported by professional analysis, and a still narrow market.

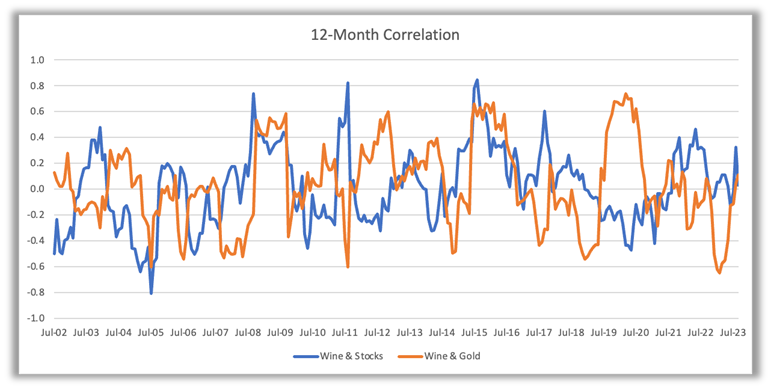

However, numerous studies confirm that investment wine shows a low or negative correlation to stocks and bonds. This makes it particularly attractive in turbulent times: it can cushion losses when the rest of the portfolio suffers. And vice versa.

But beware: correlation is not static.

During financial crises, the correlation between assets tends to increase, as can be seen in the chart below.

Usually independent assets start to move in unison. Therefore, it is crucial to analyse the correlation in different market regimes: bullish phases, bearish phases and panic situations.

Investment wine can maintain its diversification properties-or behave more like other assets if investors need to sell quickly for liquidity needs.

Diversification within a wine portfolio

Even within a wine portfolio, diversification is crucial. Relying on a single producer, a single region or a single vintage is risky. A well constructed portfolio balances:

– Producers: a mix of iconic names (such as Lafite) and emerging labels

– Regions: Bordeaux, Burgundy, Champagne, Barolo and others

– Vintages: focus on the best vintages (on-vintages) for consistent appreciation over time, but do not neglect weaker vintages (off-vintages), which can offer interesting tactical opportunities.

Diversification reduces specific risk that is, the risk associated with a single wine or producer.

But it does not eliminate market risk: the risk linked to the overall performance of the sector. And in the last two years, the market has gone through a complex phase. A well-diversified portfolio would not have avoided the losses, but it could have cushioned their impact.

Wine as a market indicator?

Investment wine is not just an alternative investment.

Research published in The Journal of Investing by Patrick Kuok-Kun Chu studied the interaction between wine indices (in particular the Liv-ex Fine Wine 100) and stock markets. Using advanced econometric models, the study shows that wine could offer anticipatory signals, and that discerning investors could exploit these to rebalance portfolios before others.

One of the reasons is that wine, being a luxury good and therefore considered ‘superfluous’, is also a cyclical good, highly influenced by interest rate cycles. This could explain its tendency to anticipate stock market movements.

In order to fully understand this link, it would be interesting to study it further.

In summary

Owning assets that behave differently reduces the overall risk of the portfolio.

A principle that applies to finance but, as the saying goes, also to life!

Investment wine is not the solution to everything.

But, integrated intelligently, it can make the portfolio more stable. And, perhaps, help to guess in advance in which direction the market will move!