Every market bubble tells the same story: too much money chasing too few assets.

One could argue that optimism is the fuel of unrealistic expectations.

Someone always knew someone else who struck it big—selling a Burgundy to cover a divorce or flipping Champagne for a flat deposit. The allure of quick wins was irresistible, drawing investors in. Headlines like “Fine Wine Outperforms Gold & Equities” and “Fine Wine Favoured Over Gold During Economic Uncertainty” dominated the market. Ironically, such headlines are often cause for concern—and this time, they were.

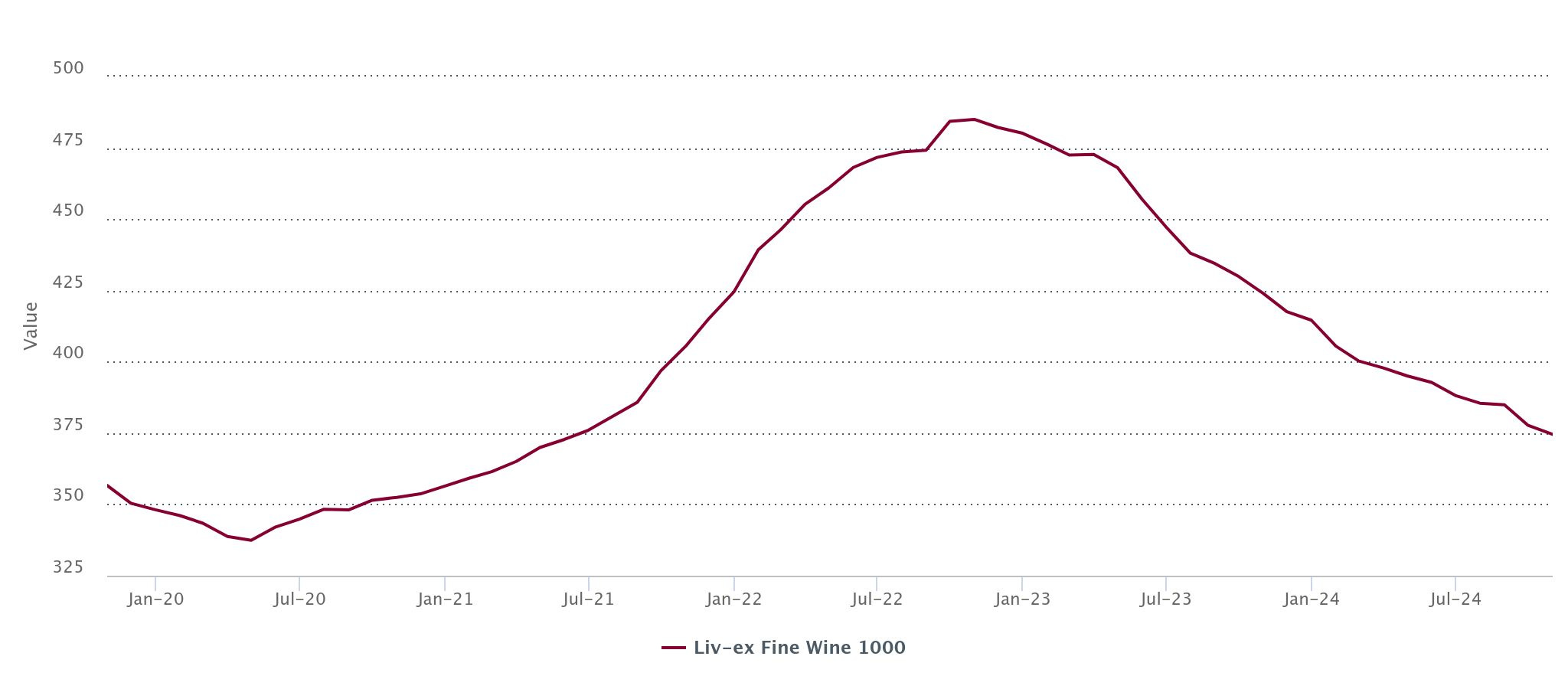

As many of you will recall, the fine wine investment bubble burst almost exactly two years ago.

By July 2022, declines began in Burgundy and Champagne, regions that had seen the sharpest price surges. By mid-2023, the contraction became widespread, affecting nearly every fine wine category. Since its peak in October 2022, the Liv-ex 1000 Index—a key fine wine benchmark—has fallen by 23%.

The fine wine bubble of 2020-2022 revealed fundamental flaws in the wine industry.

The biggest crack? Release prices.

Many producers raised prices to match bubble valuations, leaving buyers burned when the market corrected. This pricing strategy has eroded trust, with some customers hesitant to pay premium prices for new vintages after experiencing losses on prior investments. As a result, the lack of confidence has further fueled the downward market spiral we are in now.

In addition, demand from China and Asia has significantly slowed. For over a decade, strong demand had been driving up prices for Burgundy and other top wines. But by 2022, the economic strain from China’s post-Covid policies and a weakened real estate market started to affect middle-class spending.

These factors created a “perfect storm” that shattered the illusion of perpetual growth in fine wine prices.

Since its peak in October 2022, the broad Liv-ex 1000 Index—a key benchmark for the fine wine market—has dropped 23%, with no clear signs of recovery.

Don’t miss the rest of the article on Substack: https://www.inthemoodforwine.com/p/down-markets-favour-the-audacious?utm_campaign=post&utm_medium=web